Russia is importing ASML equipment in parts to produce microchips. Why aren't sanctions working?

Russia has been doing its best to replace Western electronics and industrial equipment with Chinese-made or its own domestically-produced equivalents. However, figures reveal that the Kremlin has not even come close to achieving this goal over the past two years, and that half of the components that Russia imports for weapon production are manufactured by Western companies.

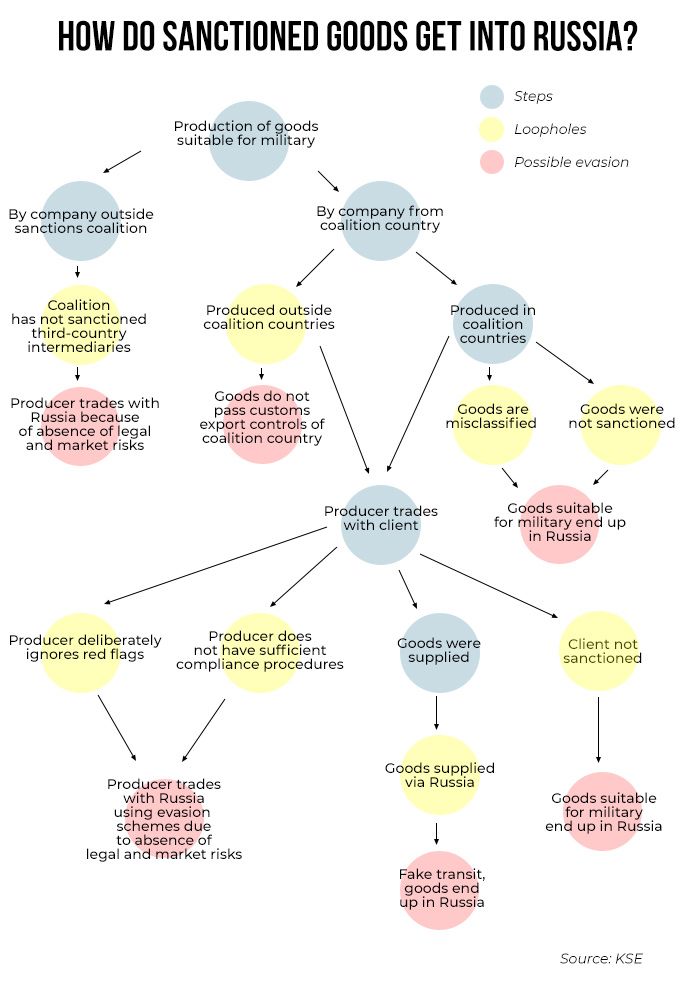

What the Russians do excel at, however, is coming up with schemes to get round sanctions. The Kyiv School of Economics (KSE) and the Yermak-McFaul Expert Group on Russian Sanctions estimate that Russia's imports of military components have fallen by only 9% since February 2022.

Ekonomichna Pravda (EP) has discovered that the Russians use dozens of import companies to secure supplies of Western industrial electronics for their plants, including second-hand Dutch equipment from ASML for producing microchips. [Advanced Semiconductor Materials Lithography (ASML) is a Dutch multinational corporation which develops and manufactures photolithography systems.]

Targeted sanctions against such Russian companies have no effect. If one importer is sanctioned, another one springs up to take its place.

But Russia's schemes to circumvent the embargo are not as sophisticated as they seem at first glance. The catch is that there are a lot of them, meaning that Western countries need to significantly tighten the sanctions regime on all fronts.

How Russia buys Western microchip equipment

In terms of technology, the production of modern microchips can only be compared to flying to the Moon. Launching a semiconductor fabrication plant, or fab, requires multi-billion-dollar investments, the finest specialists, chemicals, equipment and software from some of the world’s most developed countries.

ASML, a Dutch company, is an industry leader and de facto monopolist in the chip manufacturing equipment market. It produces lithography systems for semiconductor firms worldwide. Its products are essential for making chips for modern technology ranging from smartphones to hypersonic missiles.

In 2023, the United States pressured ASML to cancel a Dutch agreement to supply state-of-the-art equipment worth hundreds of millions of dollars to China.

Since Russia has been unable to purchase modern lithographs from this company since 2014, the Russians are hoping to produce their own version of ASML equipment.

The Kremlin is allocating RUB 100 billion (roughly US$1.1 billion) from 2023 to 2025 to develop a "sovereign" line of microchip production equipment. The Russians’ prospects appear doubtful, as the amount of funding is at least three times less than ASML allocates to equipment development in just one year.

Russia is expected to complete the production of 350-nanometre chip manufacturing equipment in 2024, at which point it will have mastered the technology of 1996. It will take quite some time for Russia to reach the point where it is manufacturing parts for its supersonic Kinzhals, or even Shahed kamikaze drones.

But the Russians can produce higher-grade microchips now by using imported equipment. There are facilities in Russia, equipped with Chinese and Dutch equipment, that are capable of producing 90-nanometre chips matching the technological level of the early 2000s.

To maintain production and expand capacity based on the Dutch machinery, imports of ASML supplies are essential. With harsher technology sanctions having been imposed in 2022, no Dutch equipment should have entered the Russian market. Yet several EP sources reveal that Russia continues to import ASML equipment, which is used by microchip manufacturers, including some working with the military industry.

According to Russian customs and open registers, ASML equipment was initially imported by AK Microtech Limited Liability Company (LLC). AK Microtech was subjected to Western sanctions in July 2023 and likely stopped importing these products.

However, a few months later the imports were resumed, this time by Krafttek LLC. EP found that this Russian firm has been submitting declarations for imports of ASML equipment since August 2023. It has since declared 16 types of equipment from ASML alone and imported US$1.8 million worth of equipment.

[BANNER1]The ASML products that the Russian company has declared include drinking water purification equipment, a gas line control unit, and a template control panel. All of these are crucial parts of the semiconductor production chain.

The equipment on this list would not be enough to build a complete microchip production cycle, but it could complement existing capabilities. Moreover, the list is constantly expanding, with the latest declaration submitted on 23 December 2023.

Learn more: How China has become Russia's leading supplier of weapons components

ASML's head office told EP that the company does not work with Russia and that it sells complete lithographic systems on the market, not individual parts.

When you look at each unit declared by the Russians, things get more interesting. It turns out that this is second-hand 20-year-old ASML equipment. Owners of obsolete lithography systems from all over the world disassemble them and sell them in parts on marketplaces. Russia purchases them and reassembles them like Lego.

ASML lithography parts are available in popular online stores. In some cases, they are listed as parts for the ASML PAS-5500 machine. The majority of these components are for this obsolete but still popular model.

Open registers and a number of media reports confirm that PAS-5500 machines of various modifications, including modern ones, are indeed used at Russian facilities, so it makes sense for Russians to buy these used components on the secondary market.

The sellers often come from countries that have not imposed sanctions on Russia, such as Singapore or South Korea. This means that the Kremlin can freely purchase equipment for its semiconductor production.

Certain models of the PAS-5500 can operate with technology down to 90 nanometres, equivalent to the level of the early 2000s. How can Russia make use of this?

"The old ASML lithography machines are designed to produce 8-inch wafers. These can support the production of microcontrollers, power supply circuits and radio frequency devices. Russia can use these semiconductors in cars, military vehicles and even tanks," Ray Yang, consulting director at Taiwan’s Industrial Technology Research Institute (ITRI), told EP, commenting on the range of equipment available on eBay.

[BANNER2]So while the imported equipment may not be at the technological level required to build processors for modern missiles or UAVs, it is sufficient for the more outdated weapons still being produced by Russia.

The Russians’ own microelectronics production also helps them to circumvent sanctions. For example, the Mikron plant in Moscow Oblast is at a sufficient technological level to produce microchips for the Mir payment system [Mir is a Russian national payment system that provides payment transaction services and issues bank cards – ed.].

This whole story proves two things.

The first is that sanctions don’t work if they are imposed slowly. One importer is quickly replaced by another. The sanctions mechanism needs to be more flexible. Krafttek LLC has been busy declaring imports of critical equipment for several months now, yet even Ukraine has not sanctioned them.

The second is that the scheme involving the import of ASML industrial equipment is just the tip of the iceberg. It’s clear from open registers that dozens of importing companies operating in Russia are declaring Western-made equipment.

This includes cables, blocks, motors, sensors, modules and fuses from leading European manufacturers like Siemens, Radiall and Schneider Electric.

As Russia seems to have been unable to completely replace Western equipment with Chinese equivalents, its industry still relies on products from US and European manufacturers. In contrast, Western countries are not taking advantage of this dependence.

Sanctions and microchips

Since Russia cannot meet its military industry's demand for semiconductors on its own, it imports them through intermediaries to get round the embargo.

In a recent report released by the Kyiv School of Economics and the Yermak-McFaul Group, experts analysed Russian imports of over 2,700 known components that are used in producing military equipment or are critical for the country's industry. The analysts found that Russia imported US$8 billion worth of military parts and US$20 billion worth of dual-use goods in the first nine months of 2023. Is this a lot or a little?

Russia now imports only 9.1% less military components than it did before February 2022. The situation with dual-use goods is slightly better, as their imports have fallen by 28.5% over the past two years. This is the main result of Western sanctions.

Roughly half of Russia's military components are Western brands. Most of them are produced at facilities in third countries such as China, making them easier for Russia to obtain. A total of 20% of the components are produced in Western countries themselves, yet the goods still end up in Russia through a string of intermediaries in China, Hong Kong, Türkiye and the UAE.

The US companies Intel, Analog Devices, AMD and Texas Instruments are the largest producers of military components for Russia among the nations in the sanctions coalition. Germany's Siemens accounts for almost half of Russia's imports of computer numerically controlled machines.

Over the past two years, then, the Russians have failed to find replacements for at least 45% of the military components produced in Western countries. Therefore, a technological embargo is still the best way to force the aggressor to end the war.

Nevertheless, the technological sanctions are in need of substantial revision. The authors of the KSE report believe that there is still potential for "tightening the screws". However, there are no more simple solutions to be found, and Western countries will need to take a multi-faceted approach to this matter.

[BANNER3]The report’s recommendations include synchronising sanctions lists between countries, extending the embargo to more product codes, imposing sanctions on intermediary companies, increasing pressure on corporations, stepping up data sharing between coalition countries, and conducting joint investigations.

Lastly, Western countries should strengthen the state institutions responsible for export control and revise the rules on critical components. Moscow will always be one step ahead unless quick and systematic decisions are made.

Translation: Artem Yakymyshyn

Editing: Teresa Pearce